Research and Development Credit Case Study – Manufacturing Industry

Download our R&D Case Study PDF

At Brown Plus, our tax professionals help manufacturers determine their eligibility and maximize their strategy for Research and Development (R&D) Tax Credit benefits.

About the R&D Tax Credit

The R&D Tax Credit rewards companies that pioneer innovation, which allows our society and our economy to flourish. Qualified Research Activities (QRA) must:

- Involve new or improved products, processes or software that result in increased performance, function, reliability or quality.

- Be technological in nature based on one or more of the hard sciences, such as engineering, physics, chemistry, biology or computer science.

- Attempt to eliminate uncertainty about the development or improvement of a product or process.

- Involve a demonstrable evaluation of alternatives for achieving the desired result through modeling, simulation, systematic trial and error or other methods.

The credit provides a tax break for certain Qualified Research Expenses (QRE) incurred from investing in QRAs, including wages, supplies and qualified contract expenses. The R&D Tax Credit is an excellent strategy for reducing a company’s federal and state tax expenses, freeing up capital to invest elsewhere in the business.

Manufacturing Business Activities That May Qualify

Almost any company that resolves challenges in an innovative way is potentially eligible for the R&D Tax Credit. The manufacturing industry may be exceptionally well-positioned to qualify for the credit by:

- Developing new or improved quality assurance testing processes to increase product reliability or overall performance

- Building and testing first article prototypes

- Designing custom tooling and fixtures

- Converting a manual process into an automated one

- Improving the durability, strength and/or service life of a part, while still ensuring its quality and integrity

The R&D Study Process

In order to help manufacturers and other clients identify their eligibility for the R&D Tax Credit, our professionals follow a study process including the following steps:

- Technical and financial data is obtained regarding the Company’s processes and procedures in order to substantiate QRAs and QREs for the tax years included in the report.

- The involvement and contribution of eligible employees towards QRAs is determined, and interviews are conducted with management and employees involved with the research and experimentation process.

- QREs are quantified and funding sources are reviewed to determine the possible impact on R&D tax credits.

- Schedules and supporting documentation are prepared.

Manufacturing Company R&D Credit Case Study

Manufacturing Company A engaged Brown Plus to conduct an R&D Tax Credit Study. QRAs and QREs for this study were identified and Brown Plus documented the activities of each department where QRAs were undertaken.

Company A’s qualifying activities included improving their manufacturing process by hiring a contractor to design, build and install guards on their recutters and conveyors used in their production lines. These guards reduced and prevented injuries by blocking hazardous areas and reduced downtime. To increase productivity, Company A also initiated a project to replace its manual packaging with a flexible, automated packaging line. This included process flow analysis, efficiency studies and equipment selection and testing.

The activities were analyzed to determine their eligibility under IRC Section 41 and a sampling of projects was reviewed to support the departmental QRAs. The final step was to organize the competed documentation and other supporting materials into a study. This study serves as the main source of information for the examiner to determine whether these activities and projects satisfied the IRC Section 31 criteria.

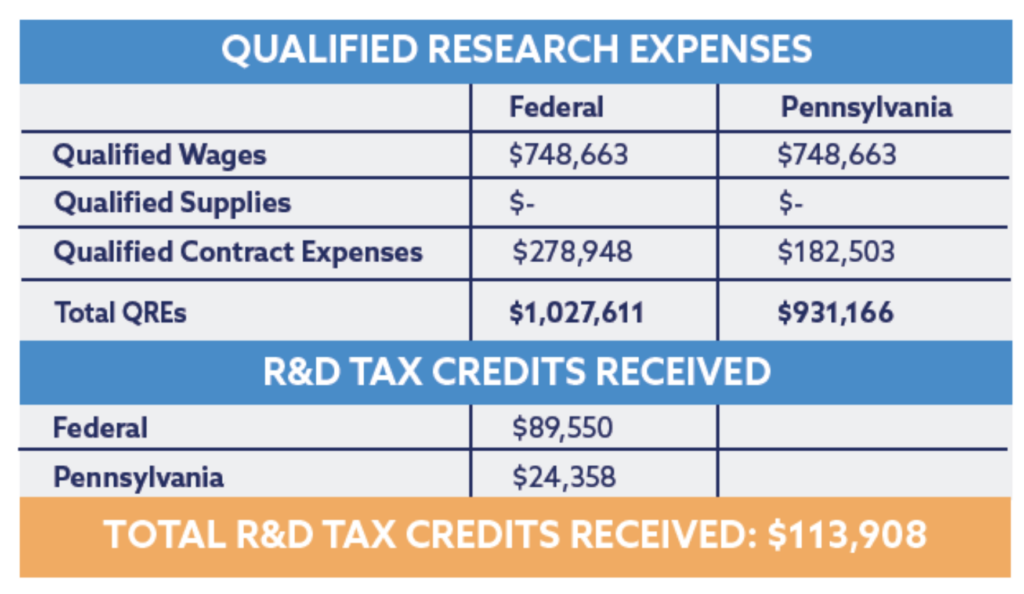

The breakout of the QREs and R&D Tax Credits received is summarized below: