PA Educational Improvement Tax Credit Program

For many years, Pennsylvania has offered an Educational Improvement Tax Credit (EITC) to taxpayers that contribute money to certain educational organizations that benefit students from pre-K to college.

Tax Credits That Can Be Received

The credits are generous, and a taxpayer can receive the following credits which can be applied to reduce the amount of PA tax due:

- 75% credit of the contributed amount, if you commit to a one-year contribution up to a maximum of $750,000 per taxable year

- 90% credit of the contributed amount, if you commit to two consecutive tax years

For contributions to Pre-Kindergarten Scholarship Organizations, business may receive:

- Up to 90% of the remaining amount contributed up to a maximum credit of $200,000 annually

- 100% of the first $10,000 contributed

There used to be drawbacks to this program. It was originally only available to corporate taxpayers, and the legislature only allocated a small amount of funds to this program. Also, once the amount allocated in the state budget was exhausted, there were no more credits available.

PA State Budget Increases School Spending

The current 2022-2023 PA budget almost doubled the amount of money set aside for this program. The budget allocates $282,000,000 (an increase of $107,000,000) for the most popular portion of this program – the EITC.

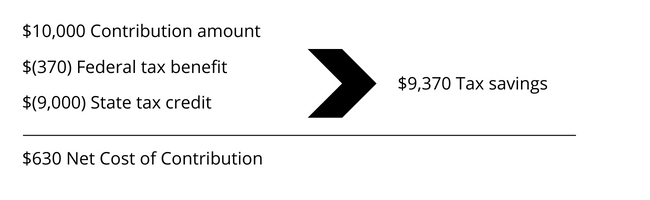

The following example shows the power of this program. Assume a taxpayer is in the 37% federal tax bracket, makes $10,000 contribution to a qualified educational entity and has Schedule A taxes more than $10,000. That person would receive a $370 federal tax benefit and a $9,000 state tax credit.

Example:

Special Purpose Entity (SPE)

The Tax Reform Code through Act 194, effective October 31, 2014, allowed the EITC program to be made available to individuals through the Special Purpose Entity (SPE) where individuals may now make contributions and receive the credits.

Pennsylvania has approved SPEs that allow a group of individual donors to participate and receive EITC and Opportunity Scholarship Tax Credit (OSTC). The sole purpose of the SPE is to receive contributions from its members, apply for the tax credits and disburse funds to approved organizations. Credits earned by an SPE can be passed through to an individual’s PA tax liability. The individual can direct the SPE to contribute to the school of their choice as tuition scholarships, provided they qualify for the program.

As with any tax strategy, please consult your Brown Plus tax advisor.