What You Need To Know About Estate Tax Exemptions

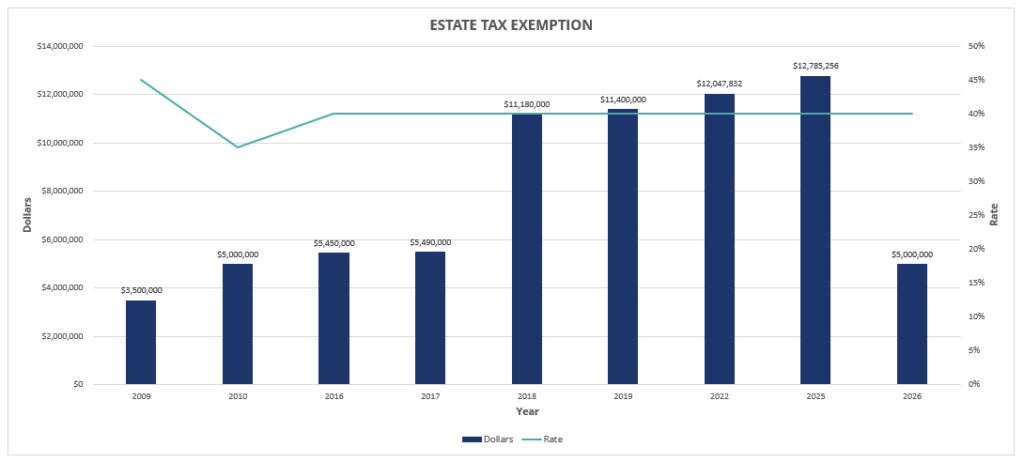

Estate taxes continue to affect fewer people over time due to extensive exemptions offered by the federal government that allow estates under a certain value to pass property tax-free. The threshold for when this tax is applied has continued to increase since 1997 and is expected to continue doing so over the next few years. However, changes are anticipated in 2026 that you should be prepared for.

What Is The Estate Tax Exemption?

Estate tax is applied to an individual’s wealth upon their death before any distribution is made to their heirs. Most estates, however, never pay the tax due to the exempted amount that can pass tax-free. The exemption was around $600,000 per person in the 1990s, increasing to $5 million per person by 2010. In 2017, the Tax Cuts and Jobs Act (TCJA) doubled the exemption to approximately $10 million until 2025, when it reverts back to pre-TCJA levels.

If the value of your estate exceeds the exemption amount for the year of your death, only the value over the exemption is taxable. Anything over the exemption amount is taxed at a rate of 40%.

The exemption is also “portable” between yourself and your spouse, allowing you to transfer any unused portion of your exemption to them. An estate tax return is still needed if you choose this option, even though no taxes will be due.

Upcoming Changes

With the exemption reverting back to pre-TCJA levels anticipated in the 2026 tax year, it is important to consider all of your options ahead of time. There are a number of options for mitigating estate taxes through charitable trusts (CRTs), intentionally defective grantor trusts (IDGTs), and irrevocable life insurance trusts (ILITs).

Contact the team at Brown Plus today to discuss a plan that makes sense for you.